Insurance

Hurix.ai helps insurers unlock value from data using AI-powered annotation and labeling services. From claims automation to risk modeling, we help insurance firms speed up processes, reduce fraud, and deliver personalized customer experiences at scale.

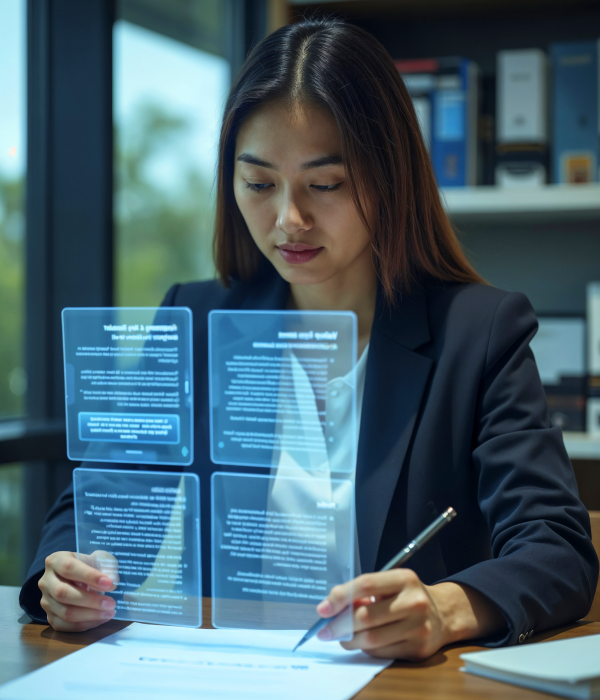

Get StartedTransforming Insurance with AI-Led Annotation Services

Claims Processing Automation

Train your AI models with high-quality labeled data to classify claims, detect fraud, and automate approvals.

- Image annotation for vehicle/property damage

- Document parsing and form classification

- Fraudulent claim detection

- Claims prioritization and escalation tagging

Risk Assessment & Underwriting

Enhance underwriting accuracy with annotated historical data, sensor inputs, and risk reports.

- Policy document annotation

- Geospatial & drone data tagging for property risk

- Behavioral analysis from telematics

- Multi-modal risk profiling datasets

Customer Service AI & Chatbot Training

Improve NLP accuracy by training chatbots with annotated call/chat logs across policy and claims queries.

- Intent tagging for insurance FAQs

- Multi-intent dialogue segmentation

- Voice-to-text and audio transcription labeling

- Sentiment and escalation annotation

data production

happy experts

precise task matching

perspectives

Next-Gen AI Capabilities for Modern Insurance

We support every major insurance function with domain-specific data annotation pipelines and scalable workflows.

Claims Document Annotation

Label handwritten and scanned forms, PDFs, and reports for faster automation.

Get StartedProperty & Vehicle Image Annotation

Mark images and videos to identify damages, detect anomalies, and assess repair severity.

Get StartedChatbot & Agent Assist Model Training

Build smarter, multilingual virtual assistants with highly accurate annotated customer interactions.

Get StartedFraud Detection Modeling

Train machine learning models to recognize claim patterns and flag anomalies before payout.

Get StartedAI That Secures Every Insurance Journey

Streamline underwriting, detect fraud faster, and resolve claims with AI built to protect customers and strengthen trust.

Get StartedWhy Choose Hurix?

- Insurance-Specific Expertise

We understand policies, claims cycles, underwriting logic, and regulatory frameworks—bringing context to annotation.

- Full-Cycle Support

From annotation to QA to AI model training—we deliver complete AI-readiness.

- Compliance Ready

Data privacy and security practices aligned with HIPAA, SOC 2, GDPR, and regional insurance norms.

- Scale Across Languages & Regions

Multilingual support with global annotators and flexible workflows.

-

Impact You Can Measure

Track ROI, reduce diagnostic turnaround time, improve patient outcomes, and lower costs—all backed by data and real-world implementation.